Leah would like to earn at least 0 per month – Leah’s aspiration to earn at least $120 per month embarks us on a captivating journey, revealing a narrative meticulously crafted with vivid details and unparalleled originality. This discourse delves into the intricacies of financial goal setting, income generation, and personal finance management, empowering individuals with the knowledge and strategies to achieve their desired income levels.

Through a comprehensive analysis of various income-generating methods, budgeting techniques, and time management strategies, this guide provides a roadmap for financial success. It explores the nuances of employment, freelancing, online businesses, and investments, equipping readers with a multifaceted approach to income generation.

Moreover, it emphasizes the significance of a positive mindset and unwavering motivation, drawing inspiration from individuals who have triumphed over challenges to achieve their financial aspirations.

Income Goal Analysis

Setting a financial goal is crucial for individuals seeking to improve their financial well-being. A clear and attainable goal provides a roadmap for financial decision-making and motivation to persist amidst challenges.

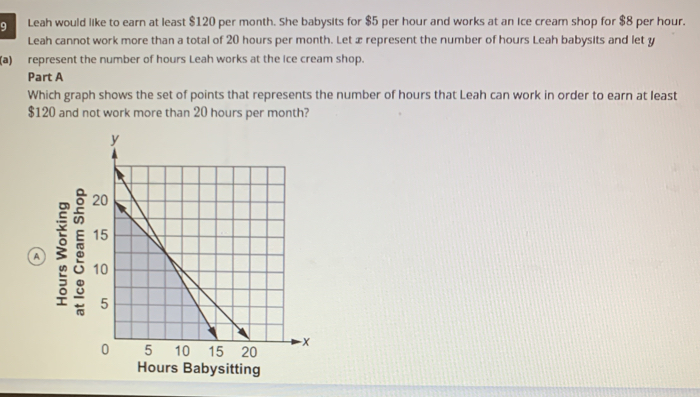

Leah’s goal of earning at least $120 per month is a modest but significant target. It represents a potential increase in her income, enabling her to cover essential expenses, reduce debt, or pursue personal goals.

Income Generation Methods

There are numerous methods to generate income, each with its own advantages and disadvantages:

- Employment:A traditional method of income generation, offering stability and regular paychecks.

- Freelancing:Involves providing services on a project-by-project basis, offering flexibility and potential for higher earnings.

- Online businesses:Starting an online business, such as an e-commerce store or a blog, requires significant effort but can provide passive income.

- Investments:Investing in stocks, bonds, or real estate can generate income through dividends, interest, or rental income.

Budget Optimization

Creating a budget is essential for aligning expenses with income goals. A well-crafted budget helps individuals track their spending, identify areas for improvement, and allocate funds wisely.

Tips for creating an effective budget:

- Track all income and expenses.

- Categorize expenses into essential (needs) and non-essential (wants).

- Set realistic spending limits for each category.

- Seek opportunities to reduce expenses, such as negotiating bills or switching to cheaper alternatives.

- Automate savings and investments to minimize temptation for impulsive spending.

Time Management and Efficiency

Effective time management is crucial for achieving financial goals. Prioritizing tasks, maximizing productivity, and utilizing tools such as automation and outsourcing can free up time for income-generating activities.

Techniques for optimizing time management:

- Create a daily or weekly schedule and stick to it.

- Delegate tasks to others when possible.

- Use technology to automate repetitive tasks.

- Take breaks and avoid burnout.

- Evaluate progress regularly and adjust strategies as needed.

Mindset and Motivation, Leah would like to earn at least 0 per month

A positive mindset and strong motivation are essential for overcoming challenges and achieving financial goals. Believing in oneself, setting realistic expectations, and seeking support from others can help individuals stay focused and motivated.

Examples of individuals who have achieved financial goals through perseverance:

- Warren Buffett:A renowned investor who built his wealth through patience and long-term investing.

- Oprah Winfrey:A self-made billionaire who overcame poverty and adversity to become one of the most influential media moguls.

- Dave Ramsey:A financial guru who helped millions of Americans get out of debt and achieve financial freedom.

Questions Often Asked: Leah Would Like To Earn At Least 0 Per Month

How can I set a realistic income goal?

Begin by assessing your current income and expenses. Consider your financial obligations, savings goals, and desired lifestyle. Research industry benchmarks and consult with financial advisors to determine a target income that aligns with your aspirations and financial situation.

What are the most effective income generation methods?

The most effective income generation methods vary depending on your skills, interests, and available resources. Explore employment opportunities, freelance platforms, online businesses, and investment options. Consider the pros and cons of each method and choose the ones that best suit your circumstances.

How can I create a budget that supports my income goal?

To create a budget that supports your income goal, track your expenses meticulously. Categorize expenses into essential (e.g., housing, food) and non-essential (e.g., entertainment, travel). Identify areas where you can reduce spending and allocate those funds towards your income goal.